Cross-Border Health Insurance Solutions for a Global Lifestyle

This post is written by a guest contributor, Serena Fung (Head of Content at Pacific Prime).

Author Bio: Serena earned her Bachelor’s Degree in Psychology from the University of British Columbia, Canada. As such, she is an avid advocate of mental health and is fascinated by all things psychology (especially if it’s cognitive psychology!). Her previous work experience includes teaching toddlers to read, writing for a travel/wellness online magazine, and then a business news blog. These combined experiences give her the skills and insights to explain complex ideas succinctly. Being the daughter of an immigrant and a traveller herself, she is passionate about educating expats and digital nomads on travel and international health insurance.

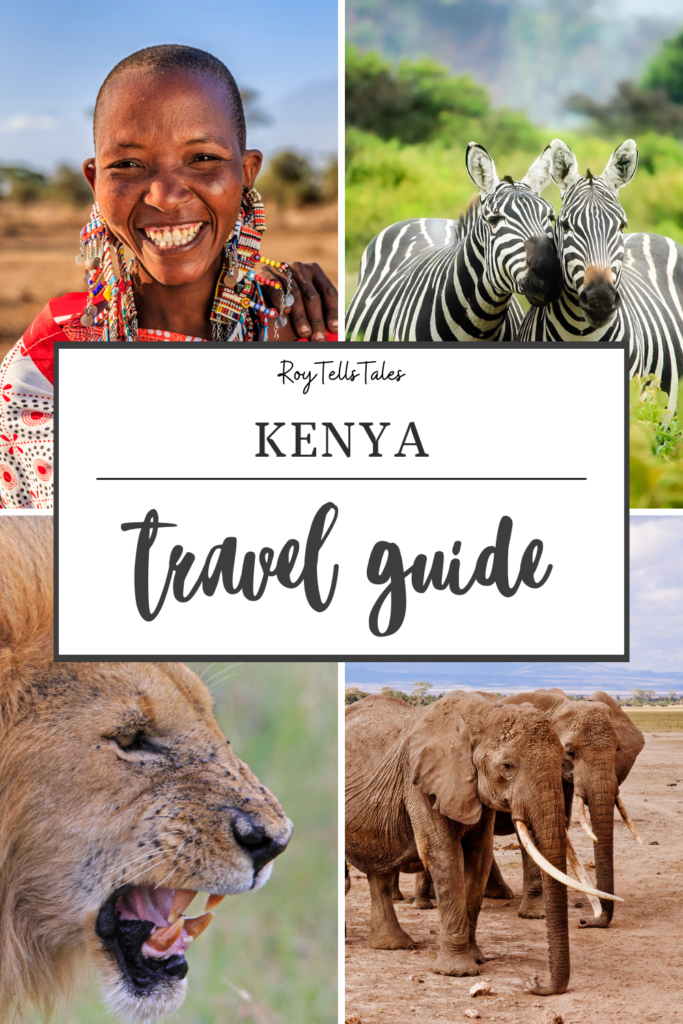

Modern professionals are redefining work and lifestyle boundaries. International health insurance has become a critical shield for those embracing global opportunities. Travellers, remote workers, and expatriates now require comprehensive healthcare solutions that extend beyond traditional domestic coverage.

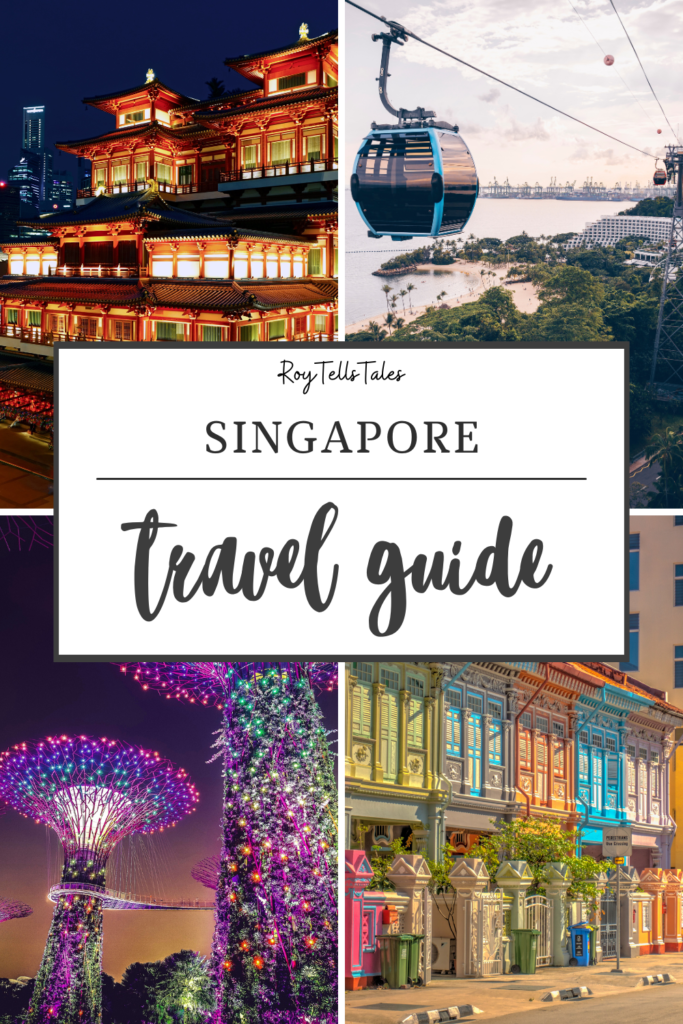

Global health coverage has become essential for people living, working, or travelling across multiple countries. Whether you’re building a career in Singapore, exploring Europe, or settling into life in Mexico, having Cross-border health insurance solutions ensures consistent medical protection and peace of mind wherever life takes you.

The world has transformed into an interconnected ecosystem where geographical limitations no longer restrict professional and personal mobility. Healthcare strategies must evolve alongside these dynamic lifestyle choices. Comprehensive international health insurance offers peace of mind, ensuring consistent medical support regardless of location.

Unexpected medical emergencies can disrupt even the most meticulously planned international journeys. Smart travelers recognize that investing in robust cross-border health protection isn’t just an option—it’s a necessity for maintaining personal security and financial stability in an unpredictable global landscape.

This guide explores the intricate world of international health insurance, providing insights into selecting optimal coverage for diverse global lifestyles. Readers will discover practical strategies to safeguard their health while embracing worldwide opportunities.

Understanding Cross-Border Health Insurance Solutions

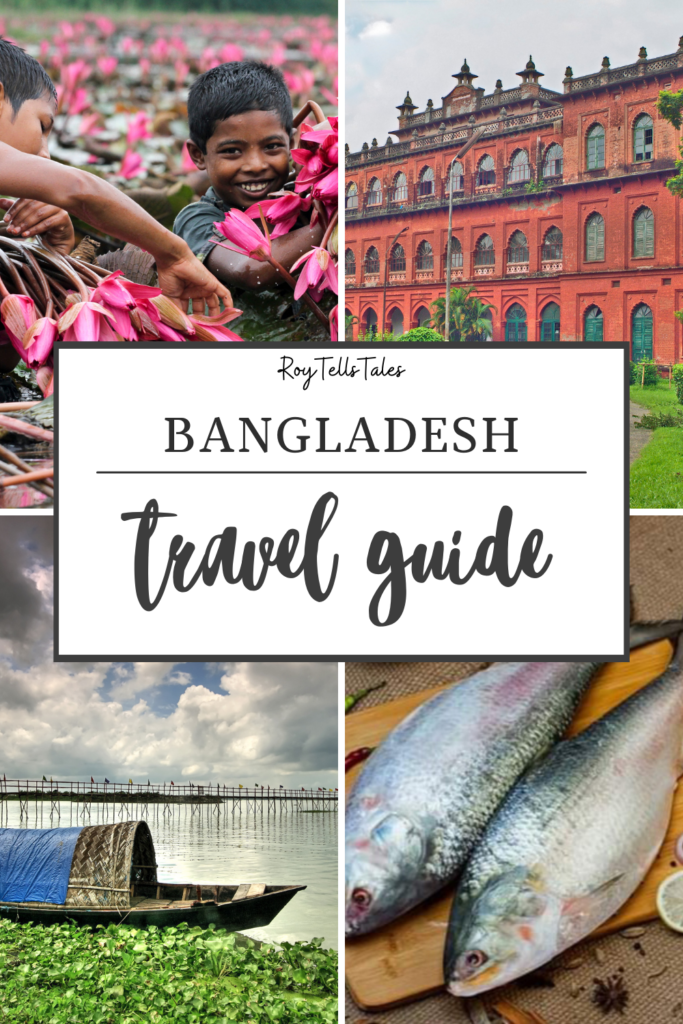

Navigating healthcare across international borders requires specialised protection. Travel medical insurance has transformed how people manage their health while moving between countries. Modern travellers and global professionals need comprehensive coverage that adapts to their dynamic lifestyles.

The landscape of international health protection differs dramatically from traditional domestic insurance models. Worldwide health benefits now offer flexible solutions for people who live, work, and explore beyond traditional boundaries.

What Makes International Health Coverage Unique

Cross-border health insurance stands out through several critical features:

- Geographic flexibility across multiple countries

- Portable coverage that moves with the policyholder

- Comprehensive multi-country coverage for varied healthcare needs

- Global network of medical providers and facilities

Key Benefits for Global Professionals

Digital nomads and expatriates gain significant advantages with specialised travel medical insurance. These plans provide:

- Seamless healthcare access in different countries

- Emergency medical evacuation services

- Consistent coverage regardless of geographic location

- Simplified claims processes across international healthcare systems

Selecting the right multi-country coverage ensures peace of mind for individuals embracing a global lifestyle. Innovative insurance solutions now recognise the complex healthcare needs of modern travellers and remote workers.

Navigating Coverage Options for Frequent Travelers

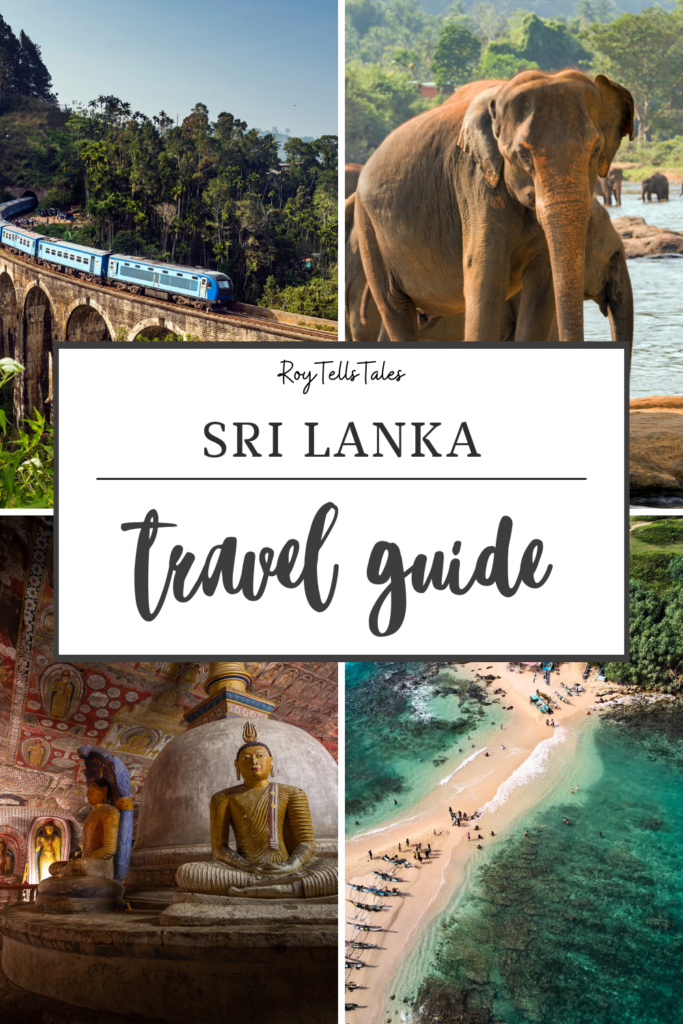

Frequent travellers face unique challenges when selecting international medical insurance. Global healthcare plans must adapt to diverse travel patterns and individual health needs. The right expat health insurance can provide peace of mind during international adventures.

Travellers need flexible insurance solutions that match their dynamic lifestyles. Different global healthcare plans offer various coverage options:

- Annual multi-trip policies for multiple international journeys

- Long-term travel insurance for extended stays abroad

- Flexible international medical insurance for individuals splitting time between countries

Key considerations for selecting the right international medical insurance include:

- Geographic coverage areas

- Duration and renewal terms

- Pre-existing condition coverage

- Emergency services and medical evacuation

- Outpatient and inpatient treatment options

Understanding claim processes is crucial. Some expat health insurance plans offer direct hospital billing, while others require reimbursement. Travellers should evaluate deductible options, premium costs, and potential exclusions to find a plan matching their specific requirements.

Comprehensive global healthcare plans protect travellers from unexpected medical expenses. By carefully assessing individual travel patterns and health needs, individuals can select insurance that provides robust protection during international journeys.

Choosing the Right Plan for Your International Needs

Selecting portable health coverage can feel overwhelming for global travellers and expatriates. International insurance providers understand the complex landscape of cross-border medical coverage and offer tailored solutions to meet diverse needs. The key is identifying a plan that provides comprehensive protection while remaining flexible and affordable.

When evaluating international health insurance options, individuals should assess their specific lifestyle requirements. Consider factors like frequent travel destinations, expected healthcare needs, budget constraints, and potential family coverage. Some plans specialise in short-term travel protection, while others offer robust long-term international medical support.

Researching international insurance providers becomes crucial in this decision-making process. Look for companies with strong global networks, transparent pricing structures, and responsive customer service. Potential customers should request detailed policy documentation, compare coverage limits, and understand exclusion clauses before committing to a specific cross-border medical coverage plan.

Smart travellers invest time in understanding their insurance options. By carefully analysing individual requirements and matching them with appropriate coverage, global citizens can secure health protection that supports their adventurous lifestyle. The right insurance plan provides peace of mind and financial security across international boundaries.